are union dues tax deductible in canada

If you pay union fees for your employees the CRA may require you to report the dues as a taxable employee benefit. The CRA lets you claim the following types of dues on your tax return.

How To Calculate Payroll Tax Deductions Monster Ca

Membership dues for trade unions or public servant associations may be deducted on income tax returns.

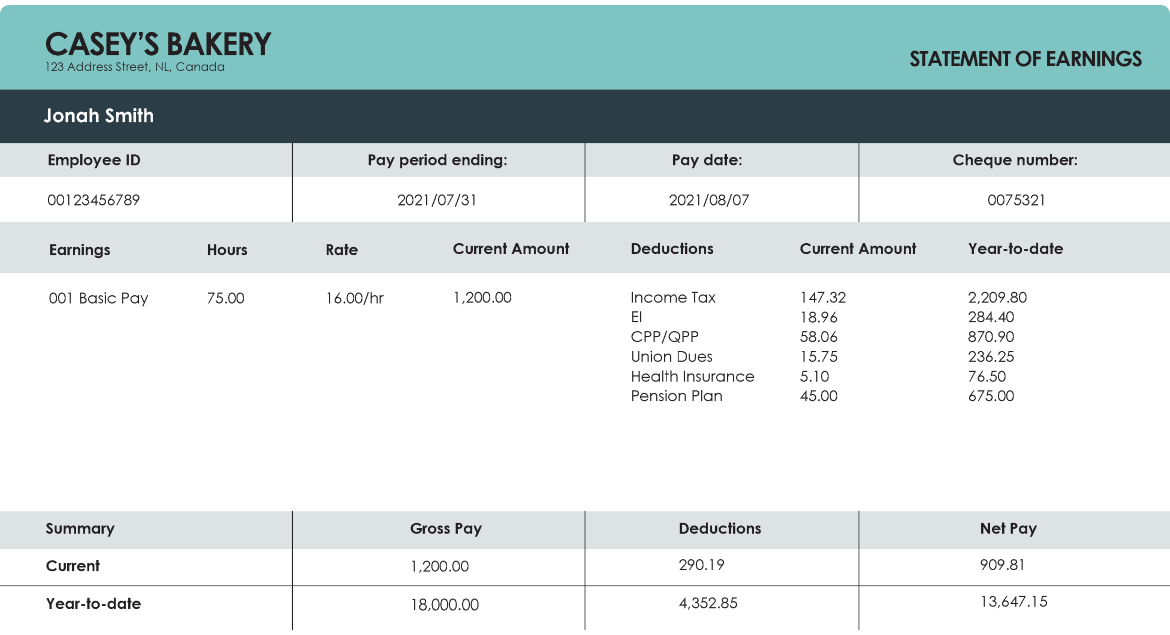

. Taxation of Union Dues. This amount can be deducted according to the Statement of Remuneration Paid section of their T4-form. Annual dues for membership in a trade union or an association of public servants.

There is no limit to the deductions so users can include the cost of dues from their income rather than their income alone. Compensation advisor to reconcile with. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense.

Union membership dues are usually deductible though initiation fees licenses and other charges cannot be deducted. In accordance with the relevant collective agreement the employer must deduct an amount equal to the monthly union dues from the pay of any employee in the bargaining unit. Get information on grievances union dues exclusions strike and crisis management and essential services.

Current PSAC deductions cease in pay system. Members of trade unions are eligible to deduct membership dues as long as they do not deduct fees licenses or other costs associated with membership. Line 21200 was line 212 before tax year 2019.

They shouldnt deduct pension plan charges initiation fees or licences. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Tax reform changed the rules of union due deductions.

Amount to be paid to PIPSC via the departmental finance office. You can claim dues related to your employment paid by you or paid on your behalf that were included as part of your income during the year. Dues for MoveUP are lower than those of most unions in Canada with less than 5 of total earnings.

The general rule for claiming such a deduction is described in the annual income tax return guide as follows. Also even though unreimbursed. Membership Dues for Trade Unions Only membership dues for a trade union are deductible other charge deductions are not permitted.

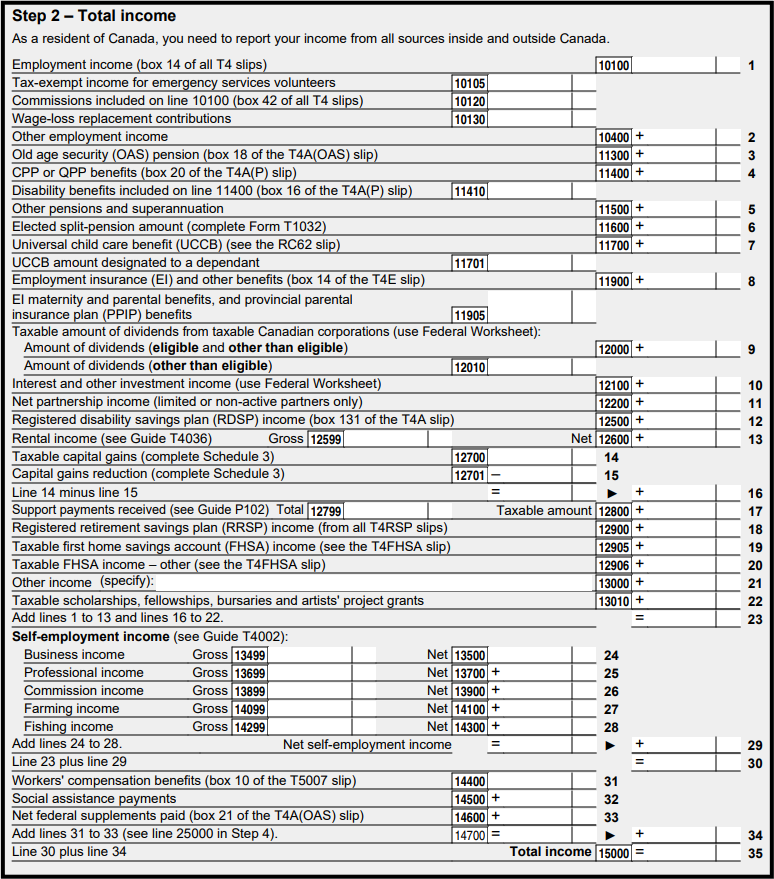

Line 212 Claim the total of the following amounts related to your employment that you paid or that were paid for you and reported as income in the year. Annual dues for membership in a trade union or an association of public. Similar to union dues you are also eligible for tax deductions on certain other items.

A bill passed by the House allows union members to deduct up to 250 in dues from their taxes. It is tax deductible for union dues and professional association fees. Initiation fees licenses and other charges may not be deducted from union membership dues.

Note You should tell your employee that they cannot deduct from their employment income any non-taxable professional dues that you have paid or reimbursed to them. Calculate amount of arrears owing to PIPSC. Are Union Dues 100 Tax Deductible In Canada.

Professional board dues required under provincial or territorial law. The amount of union fees you can claim is listed in box 44 of your T4 tickets or receipts and includes any GST HST you have paid. Are Union Dues 100 Tax Deductible In Canada.

Professionals who are required by law to pay dues for professional boards or parity or advisory committees may also deduct those fees. It can be taken by taxpayers as proof they have paid a fee in the Statement of Remuneration Pay. You can claim these amounts for a tax.

Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employement. Only union membership dues are deductible and union members may not deduct initiation fees licenses or other charges. There are various types of union dues and professional membership dues you can deduct when filing your taxes.

Are Union Dues 100 Tax Deductible In Canada. If you are a member of a trade union or professional organization you can deduct certain types of union contributions or professional membership dues from your income tax applications. You can deduct any union dues paid by you from your taxable income.

For example if your annual income is 40000 and you paid 1000 as union dues your taxable income will be only 39000. MoveUP does not issue receipts as proof of dues payment. At tax time consider reminding employees they can only deduct union dues.

Do part-time employees pay reduced union dues. Union dues and professional association fees are tax. Essentially the CRA says that if the dues benefit you the employer they are not a taxable benefit to the.

27780 from June 1 2011 to October 31 2011 5 months X 5556. Current PIPSC deductions commence in pay system. Learn about various aspects of labour relations and human resource management.

In all situations where you pay or reimburse an employees professional membership dues and the primary beneficiary is the employee there is a taxable benefit for the employee. This should satisfy any CRA inquiries into your union dues. Union dues and excluded positions.

Yearly union dues when youre a member of a. If the CRA asks for proof of which union your dues were paid to contact the payroll department of your employer and request a brief letter stating that they remitted the dues to MoveUP in 2013 on your behalf. Therefore union dues may have to be adjusted retroactively.

Are Union Dues Tax Deductible Canada Cubetoronto Com

Can I Claim Union Dues On My Taxes Canada Ictsd Org

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca

Tax Checklist For Canadian Tax Filers Free Pdf Download

Tax Checklist For Canadians Tax Checklist Business Tax Financial Checklist

10 Canadian Tax Credits Deductions You May Not Know Refresh Financial

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats And What I Payroll Template Good Essay Templates

Starting To Work Learn About Your Taxes Canada Ca

Are Union Fees Tax Deductible Canada Ictsd Org

![]()

The T1 General Tax Form A Simple Guide Piggybank

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca

Claiming Union Dues And Other Professional Fees

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Tax Prep Checklist

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca

2020 Year End Tax Tips For Canadians Cloudtax Simple Tax Application

Are Union Dues Deducted Before Taxes In Canada Ictsd Org